International Recognition of Delaware’s Fintech Opportunities

Option: 1

International Recognition of Delaware’s Fintech Opportunities

Delaware Prosperity Partnership visits Factory Berlin to share fintech report

Delaware Prosperity Partnership President, Kurt Foreman shared the findings from Delaware in a Fintech Future at Factory Berlin, one of the world’s most unique international coworking spaces, with more than 3,000 members from over 70 nations. The Delaware fintech report was researched and authored by the Delaware Prosperity Partnership, First State Fintech Lab and the University of Delaware’s Institute for Public Administration.

Delaware is already a financial services destination with world-renowned, established financial services firms including JPMorgan Chase, Capital One, and Bank of America. And now, fintech startups are thriving in Delaware’s innovation ecosystem, and mid-stage fintech companies from around the world are choosing Delaware to continue to grow. Acorns, a California-based fintech, recently opened a satellite operation at The Mill in Wilmington, Delaware while Marlette Funding is expanding and creating 200+ new jobs in the state.

As a leader in intellectual property, Delaware is competitively positioned to capitalize on the international surge of investment activity in fintech advancement. Globally, fintech investment has increased exponentially, with over $111.8 billion of investment in 2018 compared to just $18.9 billion in 2013.

Director of Research at the Delaware Prosperity Partnership, John Taylor, explained, “Delaware’s history as a leading international center for financial services—with deep workforce strength across both financial and tech occupations—has positioned the state as a natural home for both fintech startups and the established banks that have rapidly transformed into fintech companies.”

Some takeaways about fintech in Delaware:

- Delaware has the highest relative concentration of financial services jobs of any U.S. state. Among U.S. counties, New Castle County ranks third.

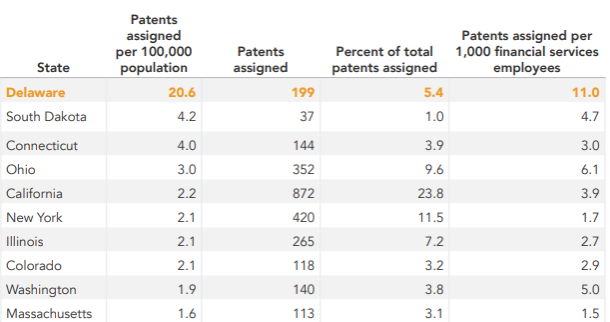

- Since 2009, nearly 200 fintech patents were assigned to Delaware-based individuals and companies, ranking first in the United States on a per capita basis, and fifth in absolute terms.

- Finance accounts for more than one-fifth of our state’s GDP, the largest contribution of any sector.

- Delaware has been a magnet for out-of-state direct investment by financial services firms in recent years, with $725 million invested since 2010. Wilmington is the leading destination in our region for this investment.

Delaware in a Fintech Future is available at www.choosedelaware.com/fintechreport.

About Delaware Prosperity Partnership

Created in 2017, Delaware Prosperity Partnership (DPP) is the nonprofit that leads the state of Delaware’s economic development efforts to attract, grow and retain businesses. DPP works with site selectors, commercial developers and business executives responsible for deciding where to move or grow a business. The team helps with reviewing potential sites, cost-of-living analysis, quality-of-life intel and funding opportunities including available tax credits and incentives. For more information, visit www.choosedelaware.com.

About First State Fintech Lab

The First State Fintech Lab (FSFL) is a nonprofit dedicated to nurturing and growing the financial technology ecosystem in Delaware by convening and collaborating across industries, disciplines, and demographics. The FSFL supports and helps foster novel public-private partnerships and dialogue; works to fill Delaware’s talent pipeline; and supports expanding opportunities and access to low investment communities. To learn more, visit firststatefintech.org

About the Institute for Public Administration, University of Delaware

The University of Delaware’s Institute for Public Administration (IPA) addresses the policy, planning, and management needs of its partners through the integration of applied research, professional development, and the education of tomorrow’s leaders. IPA is a research and public service center in the Joseph R. Biden, Jr. School of Public Policy & Administration. To learn more, visit www.ipa.udel.edu

Newsletter Sign Up

Stay Up To Date With Delaware