Forbes Fintech 50 Firm Novo Chooses Delaware as Expansion Site

Florida-based fintech platform for small businesses plans to grow as part of the Wilmington financial services hub

WILMINGTON, Del. – Novo, the powerfully simple financial solutions platform for small businesses that is a two-time member of the Forbes Fintech 50, has chosen to expand in Wilmington, Delaware.

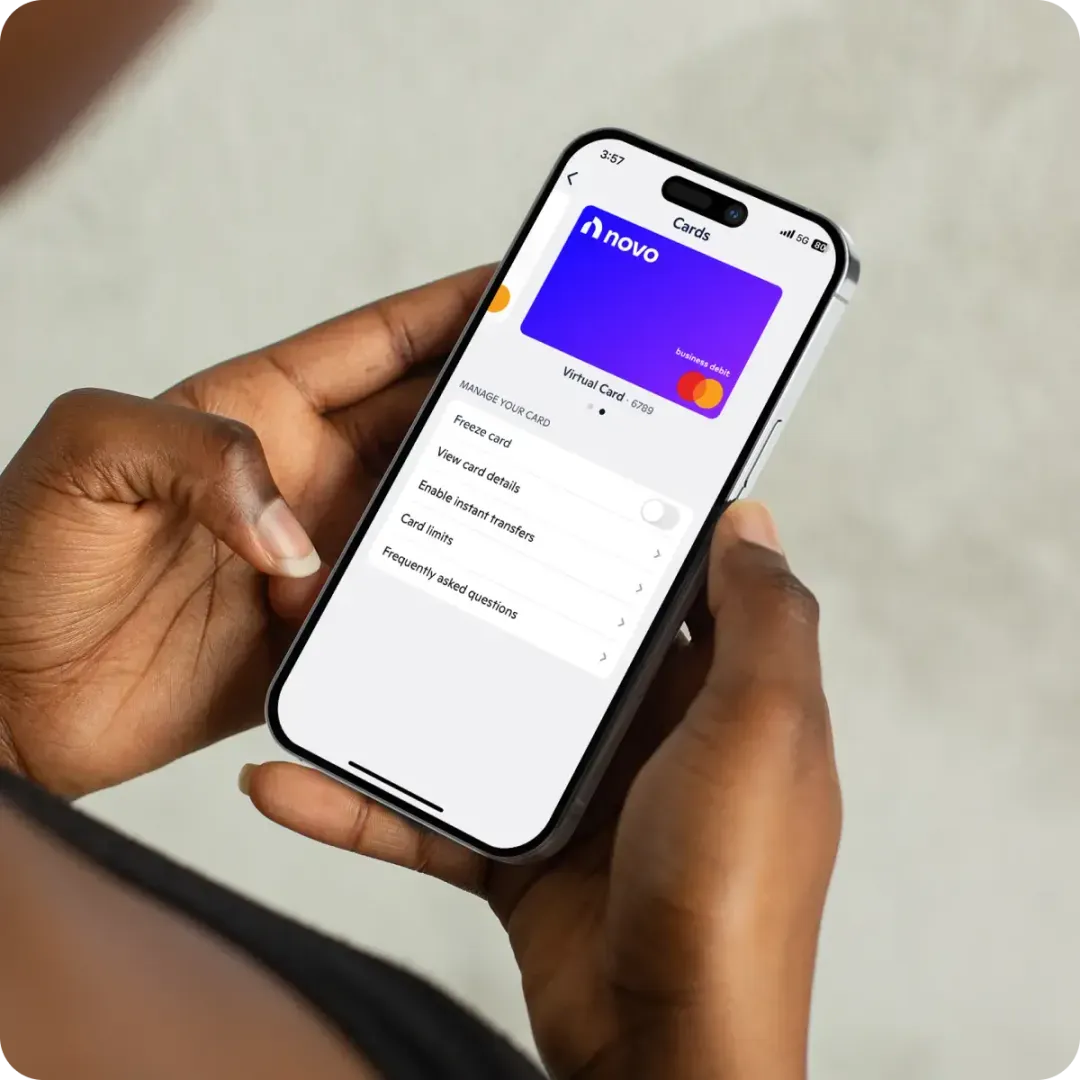

Novo has built a platform for small businesses that combines a checking account with an ecosystem of financial applications — helping small businesses access their revenue faster, save time on business-critical tasks and manage their money anytime on any device. Since launching in 2018, Novo has surpassed $20 billion in small business transactions and was named to the Forbes Fintech 50 list, which highlights “the top private companies that are transforming finance through technology” in both 2022 and 2023.

Novo is headquartered in Miami and recently opened a U.S. location in Wilmington. In Delaware, the company is operating from the Stat International space on Orange Street. Novo has hired a dozen employees since May and will continue to grow the office in the coming years.

“Novo’s decision to expand to Wilmington is great news for the First State,” said Governor John Carney. “We want to be the place companies consider when starting and growing their businesses. Novo’s move to Wilmington shows that our efforts to make Delaware inviting to corporations are working and that the Delaware Prosperity Partnership is making a difference.”

One of Novo’s recently developed offerings is Novo Funding, a fast and flexible way for small businesses to access working capital. Since its launch, Novo Funding has issued more than $70 million in working capital.

Novo’s decision to choose Delaware for its expansion further confirms the state’s status as a hub for financial services and fintech companies. Wilmington and its environs continue to be the site of significant growth for existing businesses in the financial services and fintech sector while also attracting new firms to the area. Companies with recent Delaware expansions include Ally Financial, City National Bank, Goldman Sachs and JPMorgan Chase.

“Small businesses make up more than half of Delaware’s workforce — an incredible testament to the work Delaware has done to make small business creation and growth as accessible as possible,” said Grant Sahag, VP of Operations at Novo. “The Novo team is honored to be a part of Delaware’s thriving small business community.”

###

About Delaware Prosperity Partnership

Created in 2017, Delaware Prosperity Partnership (choosedelaware.com) is the nonprofit public/private organization that leads Delaware’s statewide economic development efforts to attract, grow and retain businesses; build a stronger entrepreneurial and innovation ecosystem; and support private employers in identifying, recruiting and developing talent.

About Novo

Novo Platform, Inc. (“Novo”) is the powerfully simple financial platform for small businesses. To learn more, visit www.novo.co.

Disclosure

Novo is a fintech, and not a bank. Novo acts as a service provider to Middlesex Federal Savings, F.A., and the deposit and banking products obtained through the Novo platform are provided by Middlesex Federal Savings, F.A. Middlesex Federal Savings, F.A. is a federal savings bank and an FDIC-insured depository institution (FDIC Certificate 28368). Deposits made at Middlesex Federal Savings, F.A. through the Novo platform receive FDIC insurance protection on a pass-through basis up to the applicable legal limit. When determining the amount of your deposits covered by FDIC insurance, please note all deposits you make through the Novo platform will be aggregated with all deposit accounts of the same ownership and/or vesting held at Middlesex Federal Savings, F.A. and Middlesex Federal Savings, F.A. brands. Additional information regarding FDIC insurance coverage is available at www.fdic.gov. Merchant Cash Advance products and services are offered by Novo Funding LLC (“Novo Funding”), a wholly owned subsidiary of Novo. Merchant Cash Advances require a Novo checking account.

Newsletter Sign Up

Stay Up To Date With Delaware